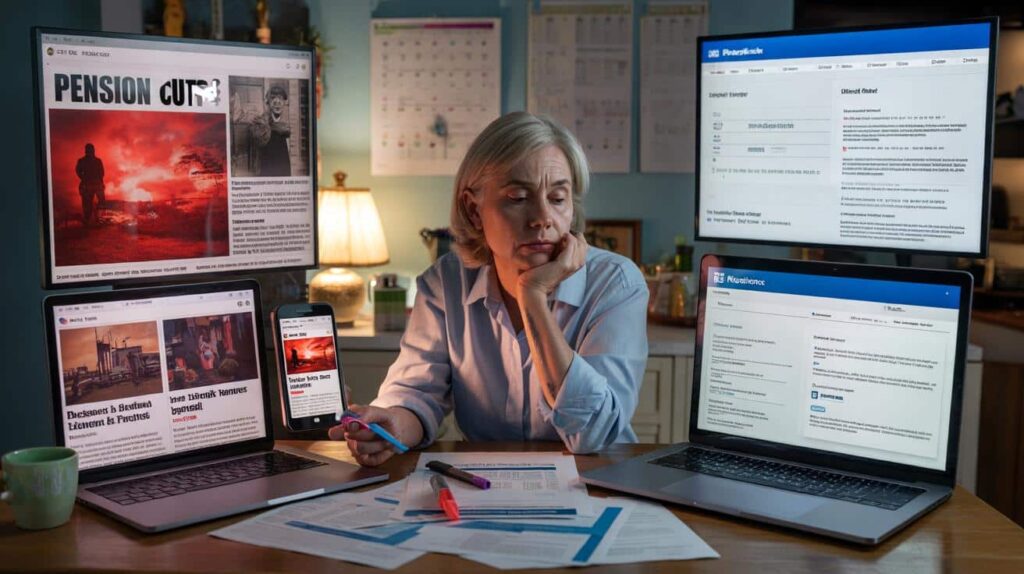

” Your stomach tightens before you’ve even opened the link. What does “slashed” mean, exactly? When? For whom? You scroll, skim a few outraged quotes, and realise you’re none the wiser about your own money.

A few hours later, the same story pops up again with a softer title: “Government clarifies pension changes.” Different outlet, different spin. Still no clear link to the actual policy. No boring PDF, no legal text, no raw source. Just interpretations stacked on interpretations.

That’s the strange thing about pension cut stories. The people who need the facts the most are often the last to see the real document.

The panic headline vs the real pension policy

You usually meet pension cuts as a feeling before you meet them as a fact. It’s that thud in the chest when a red banner shouts “Shock blow for retirees” while you’re on the bus, at work, or lying awake at 3am. Headlines are written for clicks, not calm. Policy documents are written for lawyers, not ordinary people. Stuck in the middle is you, trying to figure out if you’ll actually have less money in ten years’ time.

On social media, the story grows legs. Someone says their aunt’s neighbour is “losing half her pension”. A viral thread claims “the triple lock is dead”. None of it links to the original text. It’s like trying to judge the weather from people’s tweets instead of looking at the forecast.

That gap between pension panic and pension reality is exactly where costly decisions are made.

Take the UK’s State Pension triple lock drama in autumn 2023. Anywhere you looked, feeds were full of “triple lock under threat” and “Tories to scrap guarantees for pensioners”. Talk radio lit up with callers threatening to rip up their retirement plans overnight. But buried behind the noise was the actual government document: a dry statement from the Department for Work and Pensions, followed by the text of the Bill. No “slashing”, no scrapping, but a very specific tweak for a very specific year.

Most people never read that text. Some cancelled voluntary National Insurance contributions because they thought the whole system was collapsing. Others made rushed decisions about early retirement on the basis of a headline someone screenshot from a tabloid. The policy changed, yes, but the reality was narrower than the drama made it sound.

Statistically, this misunderstanding isn’t rare. Surveys by pension providers have repeatedly shown that a large share of people who “heard about changes” to pensions can’t say what the rules actually are. They’ve absorbed the fear, not the facts.

There’s a simple reason this happens: pension policy is boring until it’s terrifying. On Monday, a consultation document appears on a government website in 10-point font, written in bureaucratic English. No one reads it. Months later, the final policy lands with a quiet PDF upload. Again, silence. Only when someone frames it as “Your pension could be cut by £X” does the story explode into public view.

By then, the detailed document is already live. It’s there, sitting on an official site, explaining who’s affected, from which date, and under what conditions. Yet the version you see in your feed is a simplified, emotional echo. That echo is not useless, but it’s rarely enough to decide whether you need to change your retirement age, your savings rate, or your move-out-of-London fantasy.

If you want control over your future income, you can’t stop at the echo. You need the source.

The fastest route from scary headline to real pension document

So what’s the quickest way to cut through the noise and find the actual pension policy? Start where the law lives, not where the outrage lives. For UK stories, that usually means three places: GOV.UK, Parliament’s site, and the regulator. When a headline screams “Pension cuts for millions”, your first move is not to panic; it’s to search the exact phrase from the article on GOV.UK with “policy paper” or “consultation” added.

If the story is about State Pension, type “GOV.UK State Pension changes [year] policy paper”. If it’s about workplace pensions, try combining “auto-enrolment”, “defined benefit” or “defined contribution” with “GOV.UK policy”. That simple mix often pulls up the document that started it all: an announcement, a White Paper, or a formal response.

From there, follow the internal links. Dry, yes. Vital, absolutely.

Next stop is the Parliament website. Any serious pension cut that needs law behind it shows up as a Bill, an Act, or a set of regulations. Paste the name of the change into the Parliament search bar or, if that fails, just type “pensions bill [year] UK Parliament” into a search engine. Once you’re on the Bill page, scroll past the waffle until you see “Explanatory Notes” or “Impact Assessment”. Those are where plain-ish English lives.

This is where talking straight helps. *If you can’t see a Bill, an Act, or a statutory instrument, what you’re reading might be a proposal, a leak, or political positioning rather than an actual cut.*

The third-fastest path is via the watchdogs. The Pensions Regulator (TPR) and the Financial Conduct Authority (FCA) often publish clear guidance when headlines blow up. Search “FCA pension changes [month year]” or “TPR guidance [topic]”. These pages translate government language into something closer to normal speech. They’ll tell you things like: “This change only applies to schemes of type X opened after date Y.”

Soyons honnêtes : personne ne fait vraiment ça tous les jours. Yet doing it once, the next time a “pension massacre” story lands, can stop weeks of needless anxiety.

“Headlines are about attention. Policy documents are about obligation. When your money is at stake, obligation beats attention every single time.”

When you finally have the document, a few simple habits make it readable. Start with the summary or “overview” section; ignore the legalese at the end. Highlight every date. Circle every “will” and “may” – there’s a huge difference between something that’s planned and something that’s guaranteed. Look for words like “existing members”, “new entrants”, or “prospective”. They tell you whether this is about you or the next generation.

- Scan title and summary first, ignore footnotes on the first pass.

- Hunt for dates, thresholds and who is “in scope”.

- Check if this is still a proposal or already law in force.

- Cross‑check with TPR/FCA pages for plain‑language explanations.

- Only then, go back to opinion pieces and commentary.

Reading past the fear: making sense of what it means for you

Once you’ve pulled up the real paper, something interesting happens: the fear often shrinks, but the questions get sharper. Instead of “Are they cutting my pension?”, you start asking “Does this change apply to defined benefit schemes?”, “Is my small workplace pot affected?”, “What happens if I’m already retired?” Those are questions policy documents can quietly answer if you know where to look.

This is where a bit of emotional honesty matters. On a bad day, those 40‑page PDFs feel like a personal attack. They’re not written for you; they’re written for professionals who get paid to swim in this stuff. On a good day, you can treat the document as raw material and look for just three things: who, when, and how much. Who is affected in precise terms, when does anything change, and how much difference does it make in pounds per week or month.

That’s it. Anything beyond that is expert territory, and experts do exist for a reason.

When a pension cut story breaks, the biggest pitfall is reacting faster than the policy can actually move. Pensions change slowly. There are consultations, readings in Parliament, amendments, and long lead times. Still, headlines make it sound like your next payment is in danger tomorrow morning. Acting on that feeling is how people lock in real losses: cashing out early, stopping contributions, or jumping into high‑risk investments out of frustration.

A calmer route looks like this: you read the real document, you note down what might change for you, then you wait at least 24 hours before touching anything. In that time, you let regulated sources catch up – major pension providers, regulators, serious financial journalists. You’ll usually see follow‑up explainers that either dial back the drama or confirm that, yes, something big really is coming down the track.

On a human level, it helps to say out loud what many people quietly feel: On a tous déjà vécu ce moment où l’on se dit qu’on a perdu le contrôle de son futur financier. Naming that feeling doesn’t fix the policy, but it makes it easier to sit with a dry document for ten minutes rather than spiralling on social media.

- How can I tell if a pension cut story is real or just political noise?Look for a traceable source: a Bill, an official consultation, or a regulator’s statement. If everyone’s quoting each other and no one links to a government or regulator page, treat it as noise until proven otherwise.

- Where do I actually download the policy document?Start with GOV.UK for UK changes, using keywords plus “policy paper” or “consultation”. For legal text, move to the UK Parliament site or legislation.gov.uk and search by Bill name or topic.

- How do I know if I’m personally affected?In the document, hunt for sections titled “Scope”, “Who is affected”, or “Impact on individuals”. Then match those descriptions to your type of pension: State, workplace, personal, defined benefit, or defined contribution.

- Is it safe to change my pension plan right after a scary headline?Rushing is rarely your friend. Use headlines as a prompt to seek the underlying document and, ideally, regulated advice. Changes often take years to bite, not weeks.

- What if I can’t understand the policy text at all?That’s normal. Use summaries from TPR, FCA, or major pension providers. If the stakes are high, paying for one session with an independent financial adviser can be cheaper than a lifetime of guessing.

Pension cut stories are not going away. Election cycles, deficit worries, demographic shifts – they all feed the appetite for dramatic headlines about “grey voters” and “generational fairness”. Each time, your feed will light up with anger, fear, and a few people saying “read the small print” while no one shares the small print.

You don’t have to turn yourself into a policy nerd. You only need a repeatable way to jump from front‑page panic to the actual text. Over time, something shifts. The first time you open a 30‑page PDF from GOV.UK, it feels like wading through treacle. The third or fourth time, you start spotting the pattern: the sections, the consultation dates, the phrases that always appear before a real cut takes shape.

And that’s where the quiet power lies. You move from being dragged around by every furious headline to quietly checking the source and deciding for yourself how worried to be. Friends will still send you links with “Have you seen THIS?” in capital letters. You might still feel that first jolt of panic. Then your fingers go on autopilot: search, click, scroll, highlight.

In a world where outrage travels faster than facts, the fastest way to the policy document is more than a nerdy trick. It’s a small act of self‑defence that, one day, could be worth a very real amount of money.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Repérer la source officielle | Passer des titres vers GOV.UK, Parlement, régulateurs | Sortir de la panique et accéder aux faits bruts |

| Lire “qui, quand, combien” | Focaliser sur les personnes concernées, les dates et l’impact financier | Comprendre si le changement touche réellement votre pension |

| Agir lentement, vérifier vite | Vérifier les documents rapidement mais retarder les décisions | Éviter les réactions impulsives qui coûtent cher sur le long terme |

FAQ :

- How do I find the real pension policy behind a scary headline?

Copy key terms from the headline (like “State Pension change 2026”) and search them with “GOV.UK policy paper” or “consultation”. Then check the Parliament or legislation.gov.uk pages for the Bill or regulations linked to that policy.- What’s the difference between a proposal and an actual pension cut?

A proposal often appears as a consultation or Green/White Paper; it invites comment and may never become law. An actual cut shows up in legislation that has passed, with a clear commencement date and detailed rules.- Should I trust newspaper explainers about pension changes?

They’re useful for context, but you need at least one link in the chain that leads back to an official document. Treat explainers as commentary, not as the rulebook itself.- Where can I get plain‑English guidance once I’ve found the policy?

Look at summaries from The Pensions Regulator, the FCA, major pension providers, and reputable consumer finance sites. They often publish “what this means for you” guides shortly after big changes land.- What’s the one thing I should do next time I see a “pension cut” alert?

Before sharing or reacting, spend five minutes trying to locate the original policy or Bill. If you can’t, treat the story as “unconfirmed mood music” rather than a concrete hit to your future income.