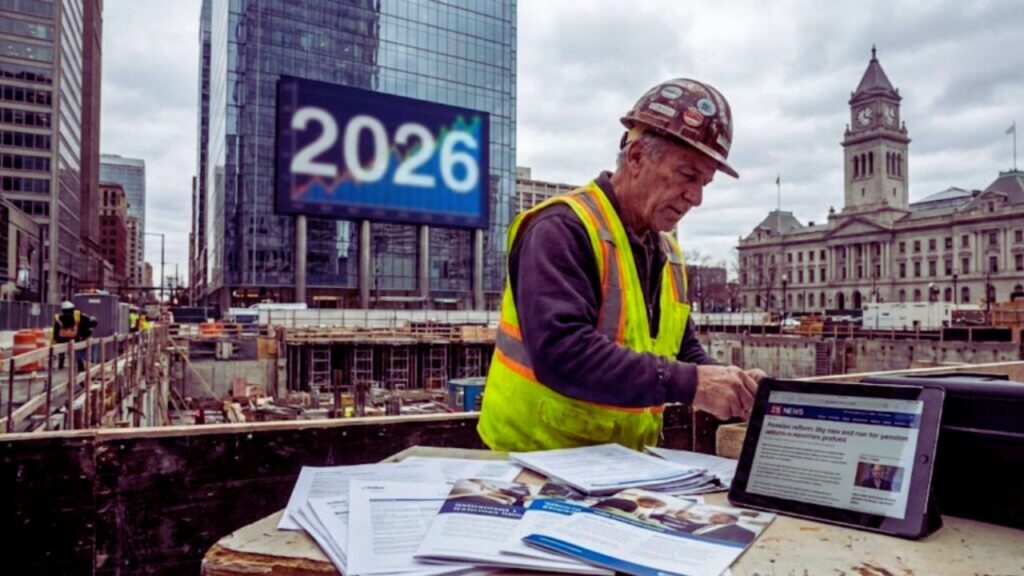

The long-standing idea of retiring at 65 is shifting quickly in the United Kingdom as new state pension age rules come into effect in February 2026. These updates are linked to longer life expectancy, evolving workforce demands, and government efforts to maintain a sustainable pension system. While the adjustments may feel uncertain for many older adults, they also encourage a fresh look at work patterns, savings strategies, and lifestyle planning. Knowing how the revised rules affect eligibility, timelines, and income expectations is now essential for anyone nearing retirement.

Why Retiring at 65 No Longer Follows the Old Model

For decades, age 65 was seen as a clear retirement marker, but updated pension policies are redefining that expectation. Under the revised framework, the state pension age is rising gradually, meaning some individuals will need to stay in work longer before qualifying. This change reflects increased longevity, higher public spending pressures, and the need to protect long-term pension funding. Many workers, particularly those in physically demanding jobs, are now rethinking career timelines. Financial advisers increasingly stress the value of early saving habits, flexible work options, and stronger retirement preparation. Although the shift may feel sudden, early awareness allows households to adjust budgets and expectations with less stress.

How Older Adults Are Adjusting to Higher Pension Age Limits

As pension age thresholds rise, many older adults are adapting in practical ways. Some continue in part-time roles, while others move into retraining or less physically demanding work. These choices help preserve income and offer a renewed sense of purpose beyond traditional retirement. The changes also underline the importance of workplace flexibility and employer support for an ageing workforce. For many households, reviewing monthly income needs and strengthening private pension savings has become increasingly important. Alongside finances, health planning plays a key role, as active ageing can make extended working years more manageable.

What the February 2026 Pension Reforms Mean for Future Planning

The February 2026 reforms are prompting people to view retirement as a long-term process rather than a fixed end point. Instead of stopping work abruptly, retirement is increasingly seen as a gradual transition. Experts advise regularly reviewing pension statements and considering long-range financial forecasts. Steps such as voluntary contributions, diversified savings, and a clear understanding of entitlement rules can reduce uncertainty. For those close to retirement, setting realistic lifestyle goals and planning for expected living costs is essential. While the reforms may feel demanding, they also open the door to a more flexible and personalised retirement path.

Key Takeaways for Older Adults Moving Forward

Moving away from the traditional retirement age of 65 represents a major shift in how later life is structured across the UK. Although the new pension age rules may raise concerns at first, they reflect wider economic and social realities. Staying informed, planning ahead, and remaining adaptable are vital for navigating this transition. By making informed retirement choices, maintaining financial confidence, and embracing gradual work transitions, older adults can face the future with greater clarity and control.

How Retirement Expectations Are Changing

- State Pension Age: Previously around 65–66, now gradually increasing after February 2026

- Eligibility Timing: Earlier access shifting to later qualification

- Work Expectations: Full retirement moving toward extended working years

- Financial Planning Focus: Short-term planning evolving into long-term preparation

- Lifestyle Impact: Fixed retirement giving way to a flexible transition