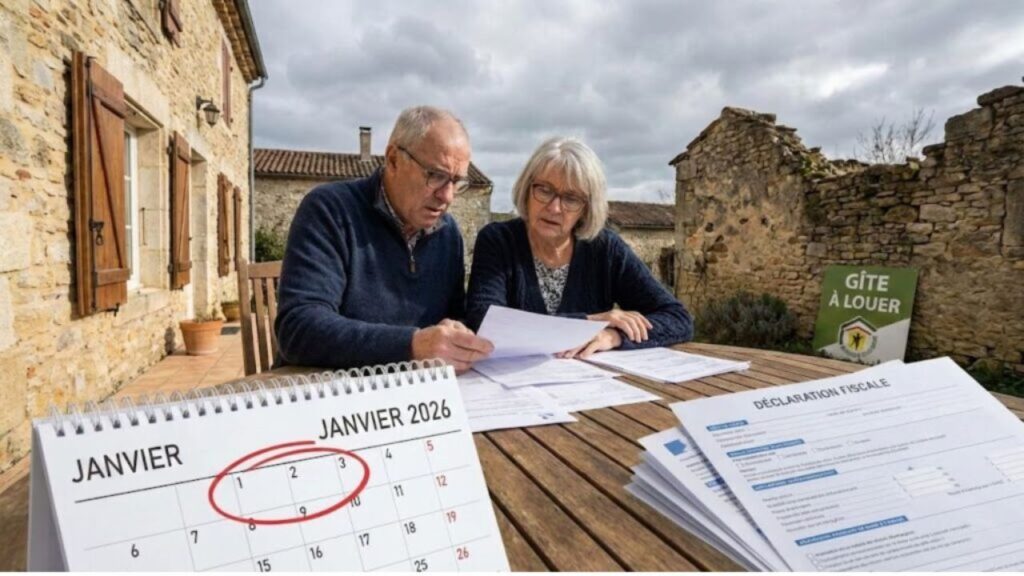

From Paris to the Atlantic coastline, owners of short-term rentals who once benefited from generous tax conditions are preparing for a major shift. A new regulation, widely referred to as the “anti-Airbnb” law, reshapes how furnished tourist rentals are taxed starting with 2025 income. The first concrete effects will appear when landlords submit their tax returns in spring 2026.

A Focused Reform Targeting Tourist Rentals

This overhaul stems from the Le Meur law, formally adopted in November 2024. Its primary objective is to push short-term rentals back into the long-term housing market, especially in cities and regions experiencing acute housing shortages.

Until now, non-classified furnished tourist properties listed on platforms such as Airbnb or Abritel benefited from favorable tax treatment. Under the micro-BIC regime, landlords enjoyed a simplified system with a substantial automatic allowance.

For income earned up to 2024, hosts could apply a 50% tax allowance on rental revenue of up to €77,700 per year. In practice, this meant only half of the income was subject to income tax and social contributions, making short-term rentals significantly more attractive than long-term leasing.

Long-term furnished rentals used as a tenant’s main residence remain unaffected. They continue to benefit from the 50% allowance and the €77,700 ceiling. The reform is strictly aimed at short-stay tourist rentals kept outside the traditional housing market.

What Will Change With 2026 Tax Declarations?

The most notable change arriving in 2026 is the sharp reduction in tax advantages previously available. Although the law applies from January 1, 2025, landlords will feel the impact when declaring 2025 income in 2026.

For non-classified furnished tourist rentals, two major adjustments apply:

- The micro-BIC income ceiling falls from €77,700 to €15,000 per year.

- The automatic allowance drops from 50% to 30% of gross rental income.

This dual reduction means many landlords will exceed the new threshold and exit the micro-BIC system entirely. Those who remain eligible will still see a higher proportion of their income taxed.

For instance, a host earning €20,000 annually would now be taxed on €14,000 instead of €10,000, highlighting how even modest rental activity faces a noticeable increase in taxable income.

Micro-BIC or Real Regime: Knowing the Difference

Under the micro-BIC regime, taxation is straightforward. The tax authority applies a flat deduction to gross rental income, with no requirement for detailed expense tracking. With the new rules, 70% of rental income becomes taxable.

The real regime (régime réel), commonly used by LMNP landlords, operates differently. It allows owners to deduct actual expenses, including mortgage interest, insurance, property taxes, management fees, maintenance, and utilities. In addition, property and furniture depreciation can be applied, reducing taxable income without immediate cash outflow.

Why 2025 Income Marks a Turning Point

French tax authorities have confirmed that all changes apply to income earned from January 1, 2025, with tax filings due in spring 2026. For many landlords, this will be the first year they encounter significantly higher tax bills.

In summary:

- Short-term non-classified tourist rentals: ceiling reduced to €15,000 with a 30% allowance.

- Long-term furnished main residences: ceiling remains €77,700 with a 50% allowance.

The broader aim is to encourage some properties to return to the long-term rental market. As a result, landlords must reassess their strategy well before filing their 2026 returns.

How LMNP Landlords Can Adjust

For LMNP landlords earning more than €15,000 per year, the real regime often becomes the most suitable option. While it requires thorough bookkeeping, invoice retention, and often professional accounting support, it can deliver a lower effective tax burden over time.

The crucial factor is whether actual expenses and depreciation exceed the 30% flat allowance. If they do, remaining under micro-BIC offers little financial advantage.

Alternative Option: Official Tourist Classification

Another possible route is obtaining “meublé de tourisme” classification. This status allows landlords to access a more favorable micro-BIC framework with a higher income ceiling and a 50% allowance.

However, the classification process requires compliance with strict standards covering comfort, furnishings, and equipment, including bedding quality and kitchen facilities. For some owners, these upgrades align naturally with guest expectations, while for others, the cost may outweigh the tax benefit.

Real-World Scenarios for 2025 Income

- Small city apartment (€12,000/year): Micro-BIC remains applicable, with €8,400 taxable. The real regime may offer limited additional benefit, but simulations are advisable.

- Coastal holiday home (€25,000/year): Micro-BIC no longer applies. Switching to the real regime or changing usage can reduce taxable income below €17,500.

- Two-property portfolio (€40,000/year): Heavily impacted. Moving to the real regime or combining long-term and short-term rentals becomes a strategic necessity.

Key Terms Every Landlord Should Understand

- Micro-BIC: Simplified tax system with a fixed allowance and no detailed expense deductions.

- LMNP: Non-professional furnished rental status, allowing a choice between micro-BIC and the real regime.

- Amortisation / Depreciation: Spreading property and furniture value over time to reduce taxable income without immediate cash expense.

Strategic Planning Becomes Essential

Seasonal rental owners must now look beyond gross revenue and focus on net income after tax, alongside evolving local regulations and community pressure. Acting early in 2025 gives landlords time to select the optimal tax regime, adjust rental activity, apply for classification, or transition to long-term leasing before 2026 tax filings are finalized.

While generous tax advantages are ending, well-located and efficiently managed properties can still remain profitable under the real regime. Careful financial planning will distinguish sustainable investments from those relying solely on short-term gains.